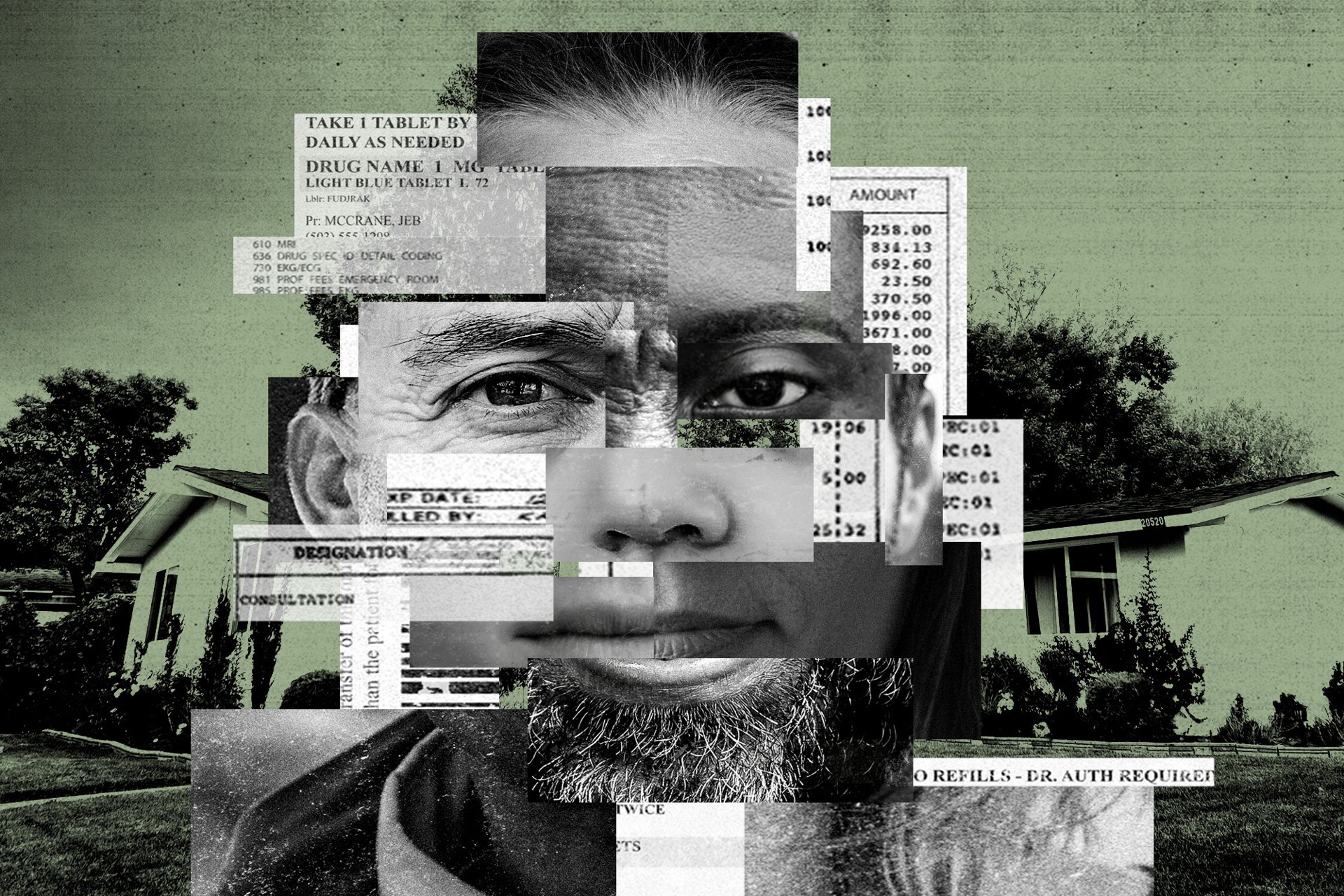

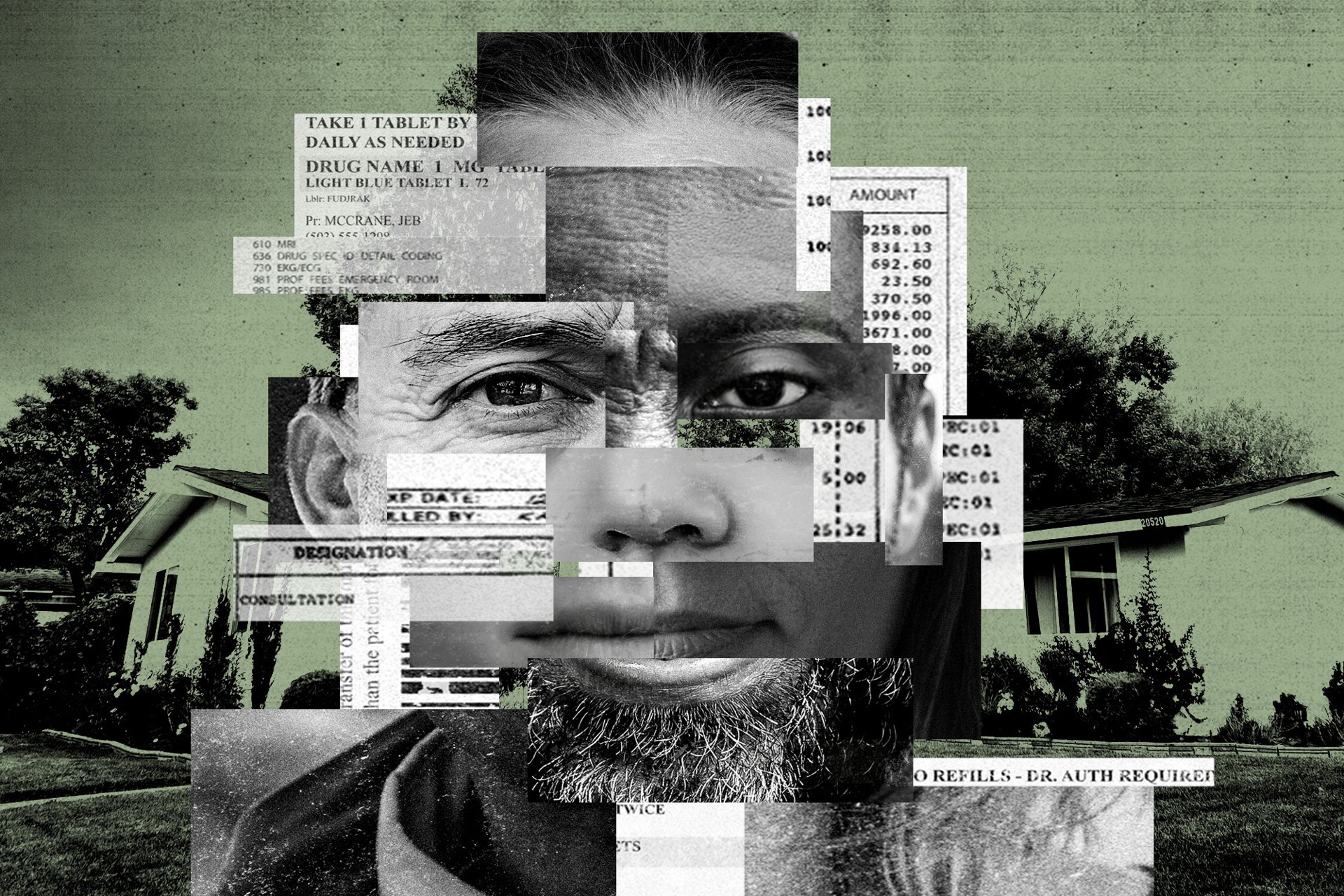

Higher income American households pay the most to finance the nation’s health care system, but the burden of payments as a share of income is greatest among households with the lowest incomes, according to a new RAND Corporation study.

Households in the bottom fifth of income groups pay an average of 33.9% of their income toward health care, while families in the highest income group pay 16% of their income toward health care.

The analysis finds that households in the middle three income tiers pay between 19.8% and 23.2% of their income toward health care. The analysis considered all payments made by households to support health care, including taxes and employer contributions.

The study is published online by the journal Health Services Research.

“Our findings suggest that health care payments in the U.S. are even more regressive than suggested by earlier research,” said Katherine G. Carman, lead author of the study and a senior economist at RAND, a nonprofit research organization. “As national discussions continue about health reform and health equity, it’s important to understand how the current health care system distributes costs and payments.”

In 2015, health care spending accounted for nearly 18 percent of the U.S.’s gross domestic product, a measure of the total value of goods produced and services provided by the nation. Ultimately all health care costs are paid by households, either in obvious ways such as through insurance premiums or out-of-pocket costs, in addition to less-visible ways such as employer-paid premiums and taxes.

RAND researchers analyzed a variety of sources of information to examine the burden that different families face to pay for health care, as well as the relationship between who pays for care and who receives care.

Researchers combined data from multiple sources collected in 2015, including the Survey of Income and Program Participation, the Medical Expenditure Panel Survey, the Kaiser Family Foundation/Health Research Education Trust Employer Health Benefits Survey, the American Community Survey and the National Health Expenditure Accounts.

Previous research has examined the distribution of health care financing, but the new RAND study considers payments made to finance health care, the dollar value of benefits received, and the impact on different groups by age, source of insurance and size of income.

The RAND study also is the first to consider the burden of health costs among people who are in nursing homes and other institutions, a calculation that led to higher estimates of health spending. The burden is particularly large on low-income people who need long-term care because in order to qualify for public benefits they must first spend most of their savings.

“We think this is a particularly important addition because those in nursing homes are among the most vulnerable in terms not only of their health, but also of the large financial burden that they face,” Carman said.

While out-of-pocket spending, including insurance premiums, is the most obvious payment most people make for health care, the RAND study found it accounted for just 9.1% of health care costs. The vast bulk of health care costs are paid through health insurance premiums and taxes.

The study found that payments to finance health care was $9,393 per person, or 18.7% of average household income.

Examining benefits by type of insurance, researchers found that Americans with Medicare receive the greatest dollar value of health care, a result of older people generally using more health care services.

Those with Medicaid have the largest dollar value of health care received as a percent of income, which corresponds to the lower income and generally poorer health among the group. People with employer-sponsored insurance received the lowest dollar value of health care.

Unsurprisingly, those with lower income are much more likely to benefit from redistribution of health care payments made by others toward health care services.

The study found that households in the three lowest income groups receive more health care services than they pay for through all forms of payments. In the fourth income group, payments and the dollar value of care received are similar.

Households in the highest of the five income groups are paying much more into the system than they receive in health care services.

“Understanding how different groups contribute to and and benefit from health care spending is difficult for researchers, policymakers and the general public,” Carman said. “This work provides better insight into how the American health care system redistributes contributions and spending across different parts of society.”